From Confusion to Correction: How One Letter Changed a Mortgage Servicer’s Reporting

By Veronica Lockett, Attorney | Veronica Lockett Law, PLLC

The Beginning: A Good Payment History, a Bad Report

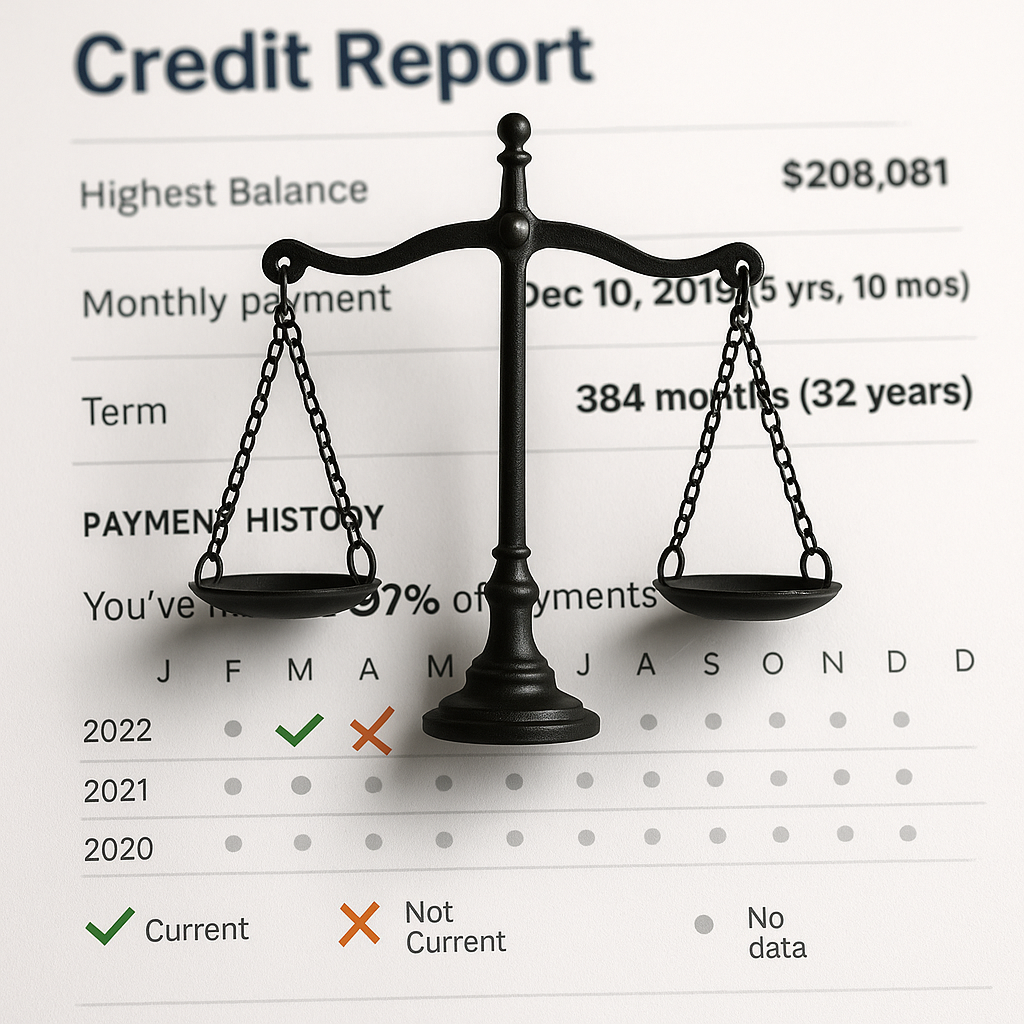

In early 2024, a client came to me with a frustrating issue. Their mortgage with Midland Mortgage had been paid in full in May 2022 when they sold their home.

But on their credit report, one thing stood out, 30–59-day late payment listed the very same month the loan was satisfied.

How could a loan be both paid off and late at the same time?

That contradiction was more than annoying, it was legally significant.

The Letter: Setting the Record Straight

Instead of disputing through the credit bureaus or relying on “credit repair” tactics, I went straight to the source of the data, the mortgage servicer.

Our letter didn’t beg for a favor. It invoked the law.

Veronica Lockett Law, PLLC reminded the Mortgage Servicer of their responsibilities under:

The Fair Credit Reporting Act (15 U.S.C. §1681s-2), furnishers must provide information that is accurate and complete, and

The CARES Act §4021, which prohibited reporting an account as delinquent if the borrower was current and in a COVID-19 accommodation, deferral, or forbearance.

The letter required the Mortgage Servicer to:

Validate the account and payment history.

Confirm whether any COVID-19 forbearance or accommodation applied.

Review whether their reporting matched the true loan status at payoff.

It was professional, factual, and firm, designed to educate the lender on what the law required, not just ask them to “fix” it.

The Review: Compliance Meets Clarity

A few weeks later, Mortgage Servicer responded.

They confirmed that:

The loan had been paid in full at the sale,

The two-month preceding the sale date were updated to show current, and

The Mortgage Servicer’s instructed the credit bureaus to update their records.

In other words, once the law was clearly laid out, they reviewed the file and corrected their own reporting.

The Result: Accuracy Restored

When the credit bureaus refreshed their data, the client’s report now reflected the truth:

✅ 97% on-time payment history

✅ No remaining late entries

✅ Account closed / paid in full

No disputes. No arguments. No collection of “round two” letters. Just legal precision, persistence, and the right statutes applied at the right time.

The Lesson: The Law Is a Tool, Not a Threat

This case illustrates something most consumers don’t realize, the credit bureaus aren’t the only players in credit accuracy. The furnisher, the company reporting the information, has equal responsibility under federal law to ensure that what it sends is correct. And sometimes, even well-meaning servicer’s need to be reminded how the law actually reads.

The Takeaway

At Veronica Lockett Law, PLLC, I don’t “repair credit,” I correct reporting through the law. When a client’s report doesn’t match reality, I don’t look for loopholes; I look for statutes. Because accuracy isn’t optional. It’s a right protected by the FCRA and reinforced by the CARES Act. This case began with one questionable late mark and ended with a clean report, and more importantly, a lender that now knows exactly how the law works.

Closing Thought

Sometimes justice looks like a courtroom.Sometimes it looks like a letter that makes a billion-dollar servicer reread the law and say, “You’re right.” Either way, that’s the work.

And that’s what we do at Veronica Lockett Law, PLLC: turn confusion into correction, one compliant report at a time.